Can I Add My Son To My Mortgage

The process of adding someone to a mortgage is quite mutual, so information technology's commonly a straightforward process. The nearly mutual scenario is calculation a long-term partner, only that'southward not the rule of thumb.

Hither's a general overview of calculation someone to your mortgage, and a couple of key points I believe yous should be enlightened of before taking the stride.

How to add someone to your mortgage

Adding someone to an existing mortgage

If you desire to add together someone to your existing mortgage you demand to contact your mortgage lender to conform it. They'll send you documents to complete, it will be a similar process to a new application, and then they'll need to verify affordability, credit history and identity of the person yous wish to add some to the mortgage.

Acquit in mind that there might be costs involved, which typically includes arrangement fees, legal fees and possibly even additional postage duty fees. Yeah, more than tax… it never stops.

Remortgaging to a joint policy

Another pick is to remortgage and apply for a joint mortgage, this will essentially entail signing upwards for an entirely new mortgage policy.

If you're non tied into the fixed-term with your current lender, and then remortgaging should be relatively straightforward. You can look for a new mortgage policy either with your current lender or a new lender altogether (transferring the debt). You tin can compare the market place with Habito (a gratuitous online specialist mortgage broker, who search the whole market place).

If you are tied into a stock-still-term, then remortgaging (in society to add someone new onto the policy) probably won't be the best option, because you lot'll probable be discipline to early repayment charges. In this instance, y'all could either add someone to your existing policy (as already discussed) or await until your stock-still term expires, and then look at remortgaging to a joint mortgage.

Married couples & their rights…

It doesn't actually thing whose name the house is under when information technology concerns married couples. Both involved have rights to the holding, so each private would have a claim on the holding irrespective of whose name or names appear on the deeds. So there's no real need to add together your partner on the mortgage if you're married.

In the event of death of the deed holder, the property will automatically pass from 1 spouse to the other, and provided life cover was in identify to repay the mortgage in that location would exist no advantage to adding a partner to it.

Calculation a non-married partner to your mortgage

If you're non married simply you lot want to add together your partners proper noun onto the mortgage, by doing then the property will ensure you lot both go fair rights if the property is sold.

Even so, if you initially purchased the belongings (before meeting your partner) and accept built upwards disinterestedness over the years, it'southward wise to protect your investment in case of unforeseen circumstances.

Nether a tenants in common organization each half of the couple own a defined share of the property agreed at the starting time. If you have a joint agreement you will jointly own the property in total. My advice would be to speak to a solicitor nigh arranging either of these arrangements.

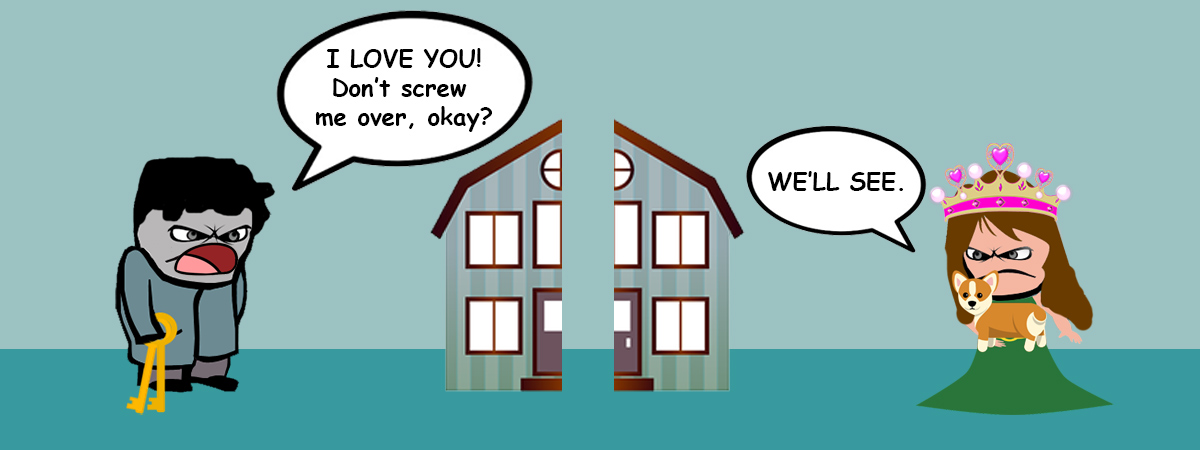

Exist careful before calculation your partner to your mortgage

I always advise proceeding with caution when it comes to calculation a partner to a mortgage. I know information technology's a negative mode of thinking only y'all should always consider "What if shit happens?"

Yeah, you could be in the all-time human relationship of your life, just that doesn't mean circumstances won't alter. Trust me, I've had a daughter tell me she loves me one week, just to tell me she wants to run across my corpse scrapped across the M24. Information technology happens. Information technology's life.

On that note, I would personally suit a tenants in common agreement if I've built up disinterestedness in a property past myself.

Sure, my partner may get offended, simply I'd feel a lot safer. If at any point nosotros carve up up, why should she sense of taste the fruits of my labour? Non going to happen.

Unfortunately, I've seen likewise many people accept gigantic hits when information technology comes to separation and real estate. 1 person is usually laughing to the depository financial institution, while the other is sitting there with their head cached in between their legs, wondering why the hell they didn't protect their asses.

If your partner has put in an as invested into the holding, or is willing to practise so, then adding them to go a 50% share seems fair.

Tenants in common – get what you deserve

If your partner will eventually invest 20% of the holding'due south value, while you're investing 80%, so you can arrange it so yous'll go the aforementioned shares dorsum if you decide to sell the property. Of class, the slicing of the pie tin can get more complicated, but that's just the general principle.

As mentioned, yous can ascertain share of the property at the outset, which I call back is the fairest way of doing information technology- you lot get back what y'all put in.

Disclaimer: I'm simply a landlord blogger; I'm 100% non qualified to give legal or fiscal advice. I'm a doofus. Any information I share is my unqualified stance, and should never be construed as professional legal or fiscal advice. You should definitely get advice from a qualified professional for any legal or fiscal matters. For more than information, please read my total disclaimer.

Can I Add My Son To My Mortgage,

Source: https://www.propertyinvestmentproject.co.uk/blog/adding-someone-to-your-mortgage/

Posted by: minertherry.blogspot.com

0 Response to "Can I Add My Son To My Mortgage"

Post a Comment